Ankit Ratan, Arpit Ratan, Ankur Pandey

Ankit Ratan, Arpit Ratan, Ankur Pandey

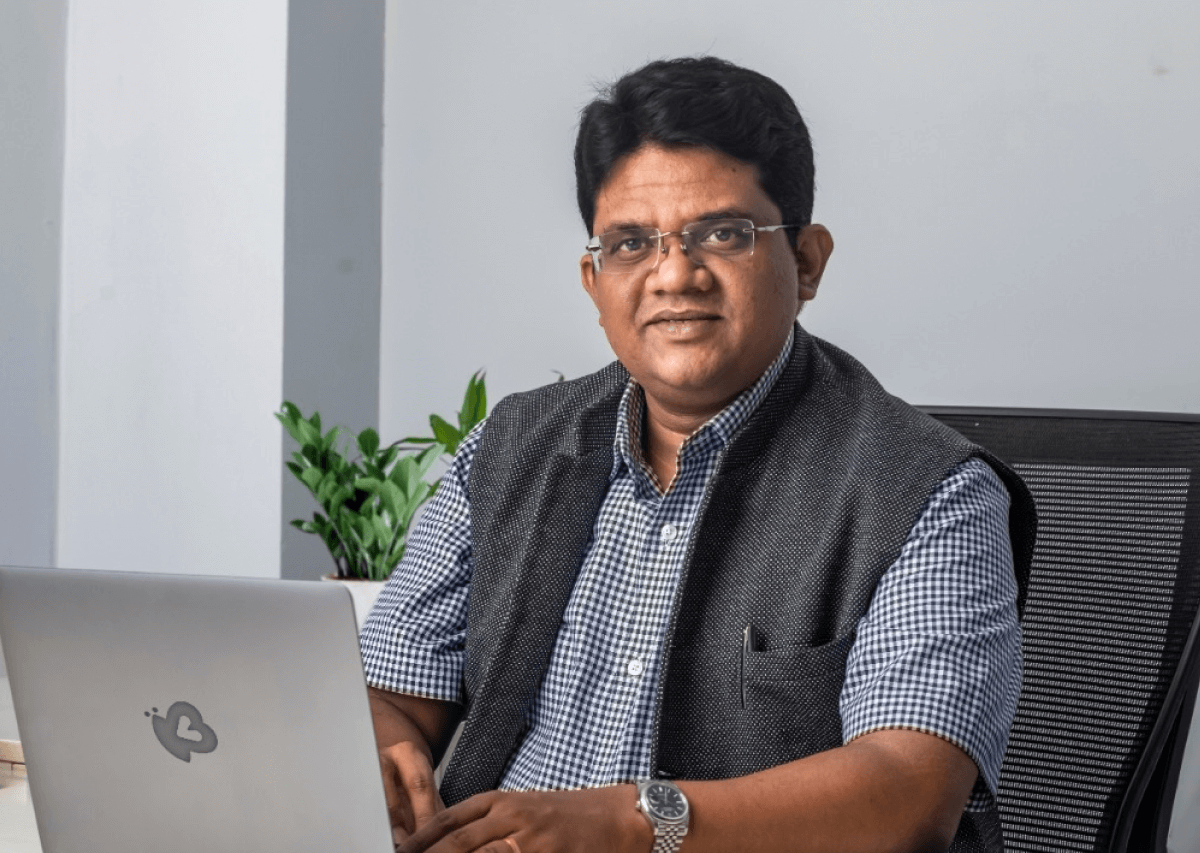

Madhusudhan E

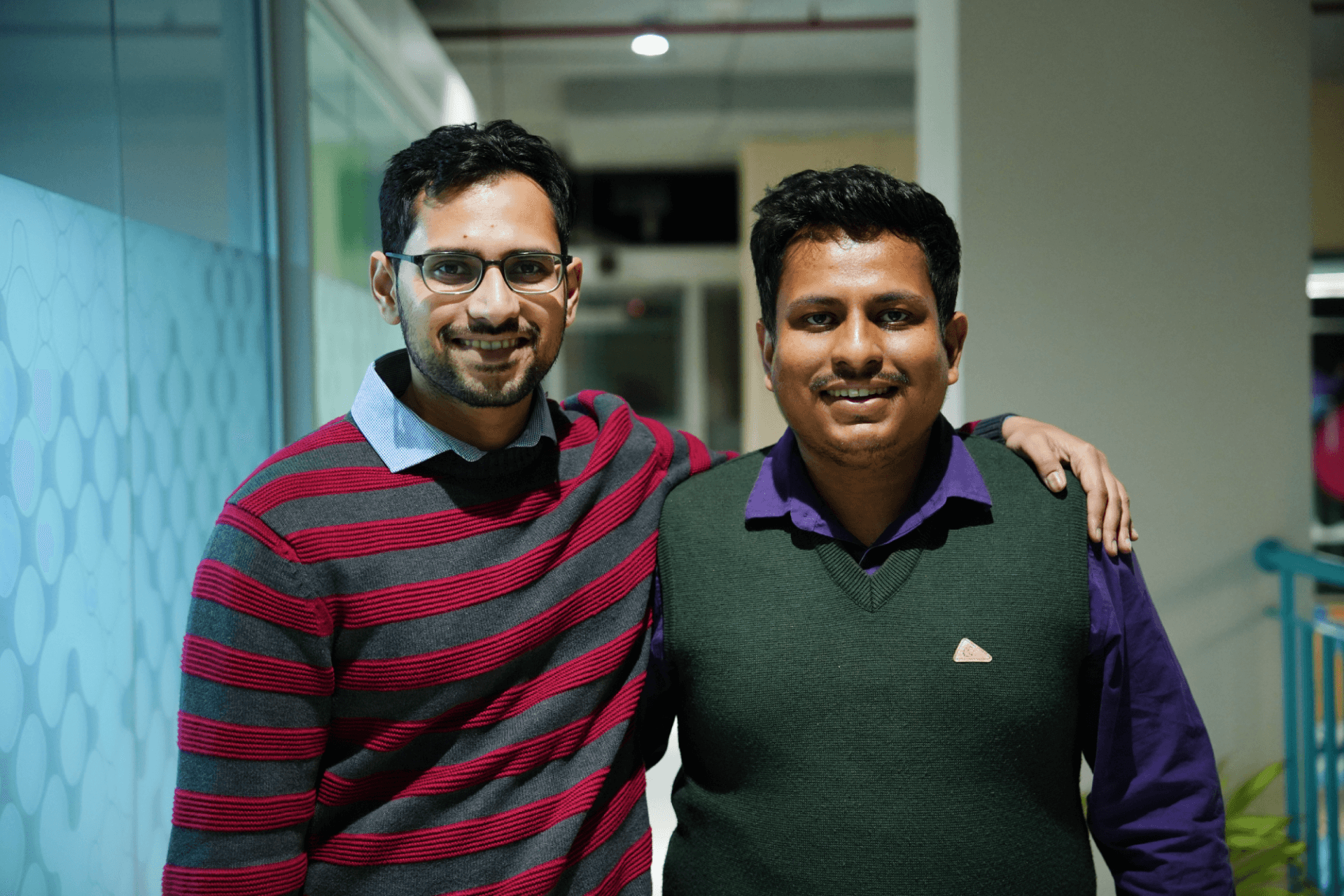

Nishchay AG, Misbah Ashraf

Siddharth Dailani, Sai Gole

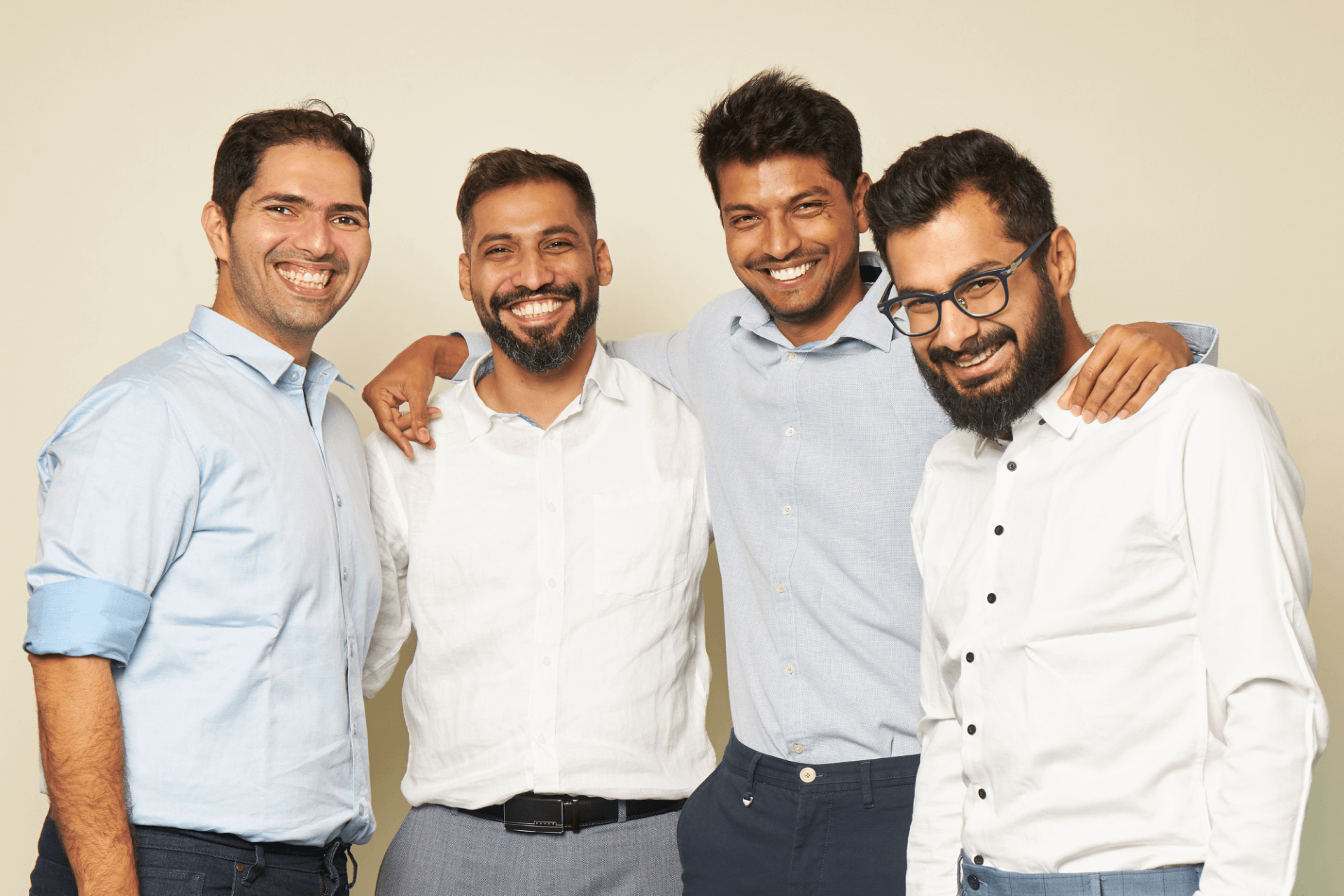

Shashank Bijapur, Rohith Salim,

Madhav Bhagat

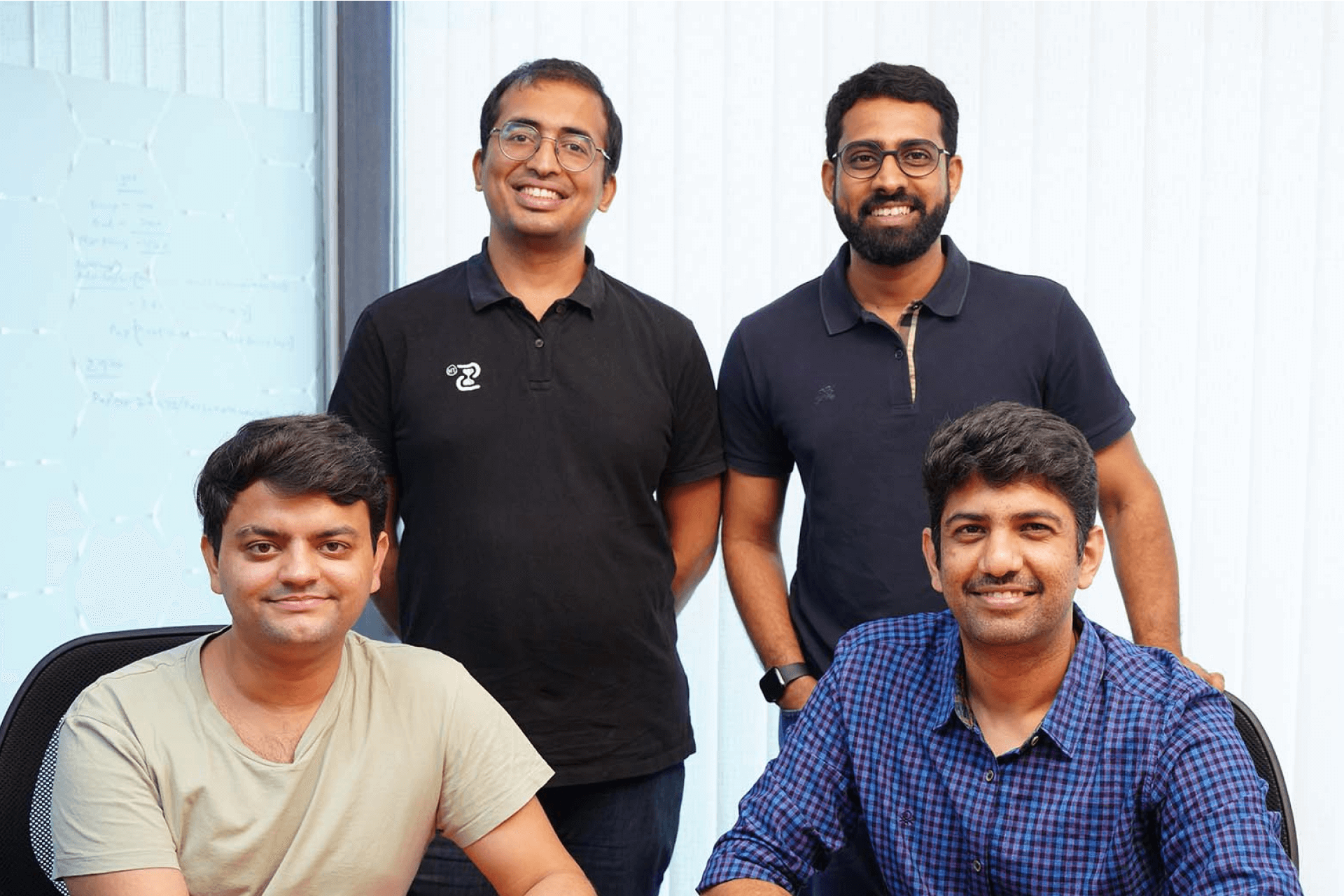

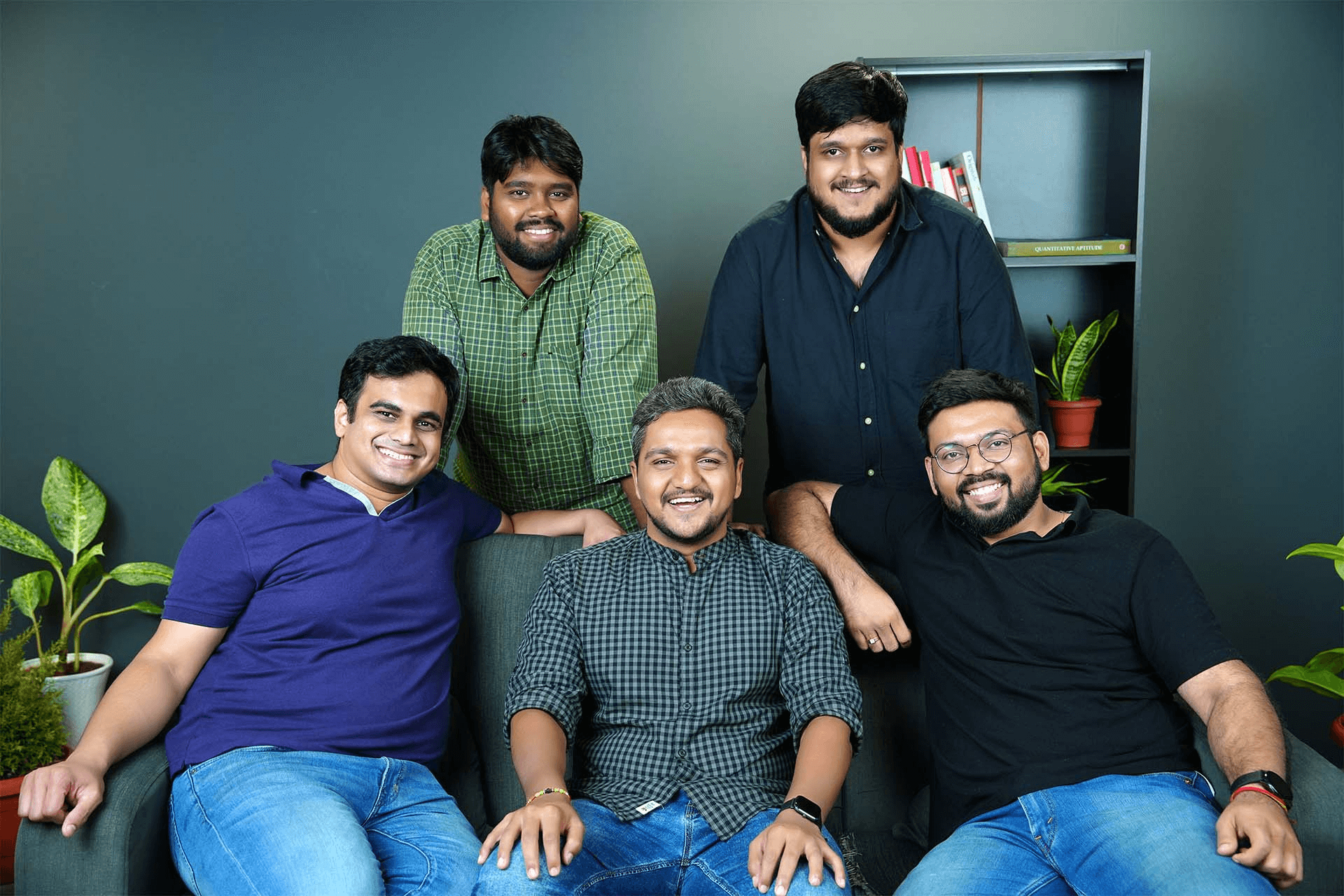

Viral Chhajer, Aravind Reddy,

Gnanesh Chilukuri, Arpit Dave

Tanay Pratap

Sonam Motwani, Karthik MC

Tanmay Yadav, Mukul Verma

Rohit Goyal, Prince Arora,

Edul Patel, Alankar Saxena

Abhinav Ayan, Anirban Chakravorty

Ajinkya Kulkarni, Anshul Gupta,

Abhik Patel, Shashank Chimaladari

Karthik Venkateswaran, Ashish Jhina

Financial Services

Food & Agri

Manufacturing

Logistics

SaaS

Sanskrit word meaning "all the way to the sun" or limitless expanse.

Arkam partners with limitless founders innovating to build a new India.